[Introducing Pocket Risk 2] Why Risk Tolerance Questionnaires Should Not Be Used For Prospecting

In recent years there has been a plethora of risk tolerance tools releasing features to help advisors acquire more clients. The theory goes by assessing a client’s risk tolerance we can know what investments best suit their psychology, a portfolio they will “stick with”.

However, this contradicts the true purpose of a financial advisor, which is to help clients achieve their long-term financial goals. Simply investing along the lines of someone’s psychology could result in a plan that has too little risk or too much.

The Customer Acquisition Challenge

Advisors like these customer acquisition features because they believe it will bring in more clients. But the real customer acquisition cure for advisors is not better technology but more trust and awareness. See research and commentary here and here.

The primary purpose of a risk questionnaire is to educate an advisor about a client’s risk tolerance, risk capacity and risk needs (goals). With this information an advisor can build a plan likely to hit the goal, without the client bailing out midway. A client’s psychology should not be ignored but it should definitely not be the main driver of a plan.

Jumping from risk tolerance to investment portfolios without adequate consideration for goals and risk capacity is a recipe for short-term satisfaction and long-term dissatisfaction.

Introducing Pocket Risk 2

Every week, advisors ask us to build more and more “customer acquisition” features. It’s tempting since, we want to make money but it doesn’t feel like the right thing in the long run. The right thing is a tool to educate advisors and clients that promotes good behavior. Since behavior is the primary determinant of investor returns.

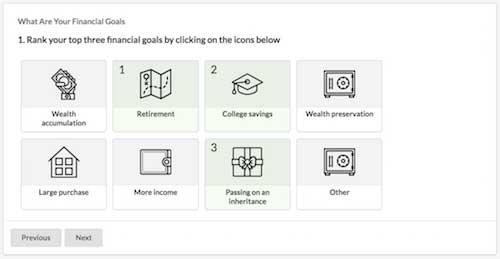

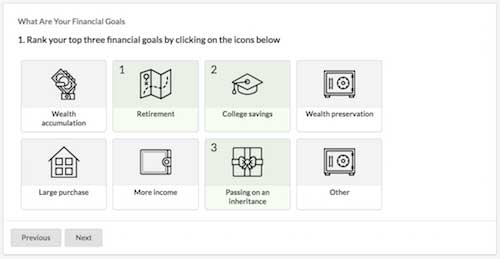

We have released a new Risk analysis questionnaire that assesses goals, risk tolerance and risk capacity so advisors can collect the information they need to build a plan that works in the long-run.

Our new feature set is about enhancing the financial planning differentiation advisors have today against robo-advisors rather than trying to compete in commoditized investment management technology. The advisory customer acquisition challenge will be won in personalized financial planning, where robo-advisors cannot easily compete.

Click here to take the risk questionnaire