3 Things Your Clients Must Understand Before You Assess Their Risk Tolerance

I recently had a discussion on Facebook with two financial advisors about risk tolerance questionnaires. The advisors expressed their frustrations with managing client behaviour. In one advisor’s words “there is an emotional element that is difficult to quantify” in questionnaires. Pocket Risk helps here but we agreed a certain level of client education is necessary to ensure people “stay the course”.

The academic and practice literature supports this. The University of Michigan’s Health and Retirement Study has shown that people with lower levels of education are less likely to take investment risk. This means they are at risk of forgoing the gains in holding equities and missing their retirement goals. Practice professionals such as Harold Evensky in his book “The New Wealth Management” have stressed the importance of client education before building a financial plan and investing.

So what do your clients need to know?

1. Your Clients Must Understand The Risk-Return Trade-off

In order to be comfortable with risk your clients need to understand what risks they are taking. At the beginning they should understand the risk return trade-off. That is the idea that as an investor you are expected to get higher returns for taking more risk.

Here is a real life example you can share with your clients. In 2004 Google IPO’ed and became a public company. The shares traded at $54 (accounting for stock splits). There was a lot of uncertainty about the company’s business model and investors were largely reluctant to invest because of the dot com collapse four years earlier. Most investors did not want to take the risk.

However, today, Google’s shares have been trading at over $750 per share. Those investors who were willing to take the risk (on a company that was eventually very successful) have received high returns. This is how the risk-return tradeoff works in action.

Conversely, people who invested in Twitter which IPO’ed in 2013 at $41 have seen their value drop to $18 dollars. These investors took a risk most people were not willing to make and they lost money.

Your clients should know, that if they wish to make more money they are probably risking greater losses.

2. Your Clients Must Understand Time Horizon

Your clients should appreciate that assets can go up and down in value but over the long term they have a trend. In the short term (0-3 years) volatility can be wild but over longer periods of time there tends to be a pattern. Therefore, the longer you invest the more certain you can be about how much money you will make.

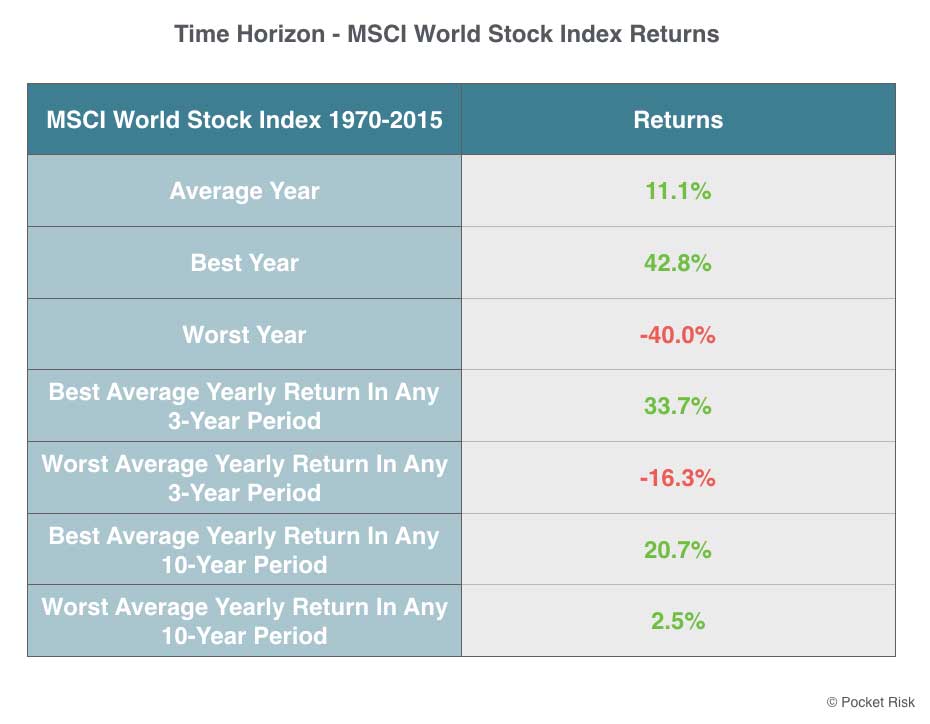

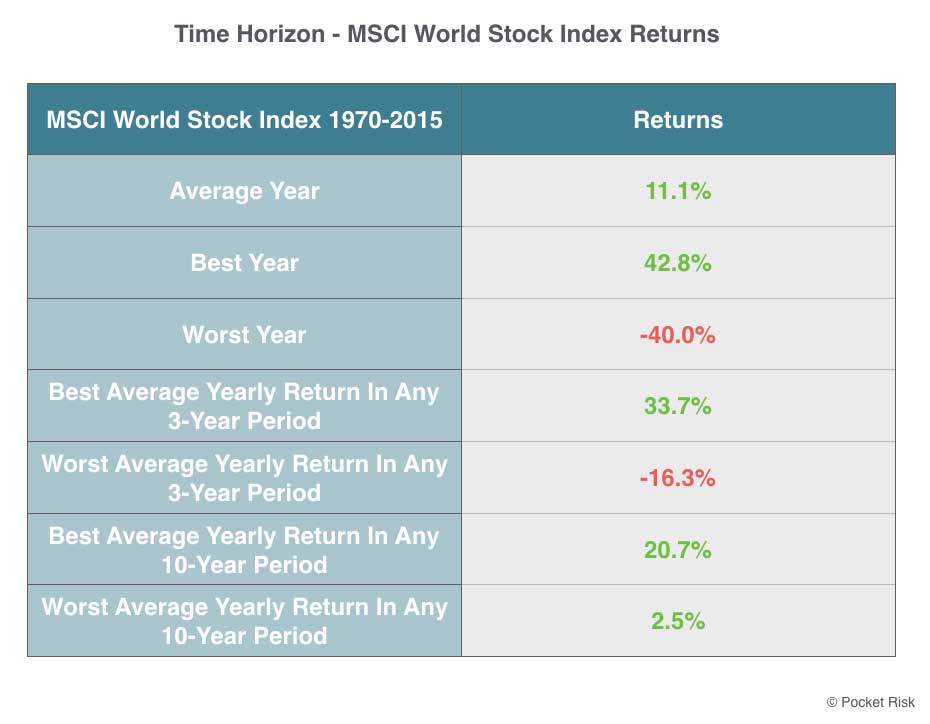

Below is a real life example you can share with your clients with historical returns of the MSCI World Stock Market Index 1970-2015 (dividends reinvested, before fees and taxes). This diagram shows your clients that investing over a longer time period means less chance of loss.

By jumping in and out of investments when assets drop in value, they will likely miss the gains on the upside. As proven by Geoffrey Friesen and Travis Sapp in their paper – “Mutual fund flows and investor returns: An empirical examination of fund investor timing ability” – 2007. We recommend you use diagrams like the below to explain key concepts to clients.

3. Your Clients Must Become Comfortable With Uncertainty

Once your clients understand the risk return trade-off and the importance of time horizon there is one last thing they must understand…

Sometimes great plans don’t hit the mark. There is a luck factor in everything that we do as humans. Your clients must understand there is no certainty in investing. However, we can use probabilities to increase our chances of achieving our goals.

Communicating this to clients can be difficult. They are paying you for results and you have to explain to them why there is a small chance you won’t deliver.

But if you use simple analogies, it can be explained. For example there is a high probability of getting into a car accident if you run red lights. There is a low probability if you follow all the rules but you can still get into an accident. It’s your job to explain how you will increase the chances of them hitting their goals.

I recommend you read a book by Nick Murray called “Simple Wealth, Inevitable Wealth”. Focus on the epilogue titled “Optimism Is The Only Realism”. Nick Murray has been a financial advisor for 50 years and a coach to thousands of advisors over the last two decades.

He believes that the dominant determinant of long-term, real-life return is not investment performance but investor behavior. Second, that behavior modification ought to be an advisor’s true value proposition, because great behavioral advice is at critical moments in an investor’s life, worth so much more. I completely agree.