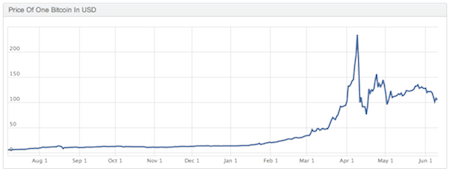

As the hype around Bitcoin recedes and the price finds a base at $108 from highs of $234 it’s time to take a measured look at the crypto-currency. Bitcoin exists as a reaction to the problems surrounding government issued currencies. Namely, that central banks can seemingly print money ad infinitum, debasing the value of our money.

It also exists to challenge the power of banks. The original source code for Bitcoin had a reference to a Times article titled “Chancellor Alistair Darling on brink of second bailout for banks.” Enough it seemed was enough. For a comprehensive background on Bitcoin’s origins and how it works I suggest you read a brilliant introductory article at Priceonomics blog.

Today I want to tackle whether Bitcoin could be a good investment opportunity for your clients. [FULL DISCLOSURE – I am long Bitcoin and have invested in the digital currency].

Step 1 – Your Client’s Risk Profile

At Pocket Risk we are constantly looking at the topic of risk tolerance, capacity for loss and need to invest. Fundamentally, you need to ask yourself whether your client’s risk profile matches with this kind of asset.

Statistically speaking the volatility of Bitcoin is comparable to a 50/50 stock and bond portfolio when you look at the daily closing prices going back to July 2010 (Source Bitcoincharts.com). That being said there are important caveats, such as the fact Bitcoin has only existed since January 2009 and remains to be tested in throughout different economic cycles.

Furthermore, just like there were no laws to govern the Internet in the early 90’s there are no laws that truly govern Bitcoin today. That means you and your clients have very little legal protection. There is no FSCS (Financial Services Compensation Scheme) for Bitcoin and cases of online theft do arise with no obvious recourse.

That being said Bitcoin is still considered an opportunity. Simply because we know from past experience that some of the greatest economic developments have come from places that started off as speculative wild wests (i.e. wildcatting in the oil rich American mid-west, China, the Internet and others).

Does your client need to take this kind of risk? Unlikely, but if they have a portfolio in place that is likely to take care of their future needs it could be worth using any surplus to invest in Bitcoin.

Bitcoin Chart – June 2012-June-2013

Step 2 – Your Client’s Philosophy

There are two types of investors in Bitcoin at the moment, those driven by the ideals and those driven by greed. I could never suggest someone invest out of greed, so look to discover whether your client agrees with the Bitcoin philosophy. If anything, it might make the blow a little softer during price falls. Here are three questions to help you discover whether your client is sympathetic to Bitcoin.

A) Are you concerned about inflation and currency devaluation?

B) Are you concerned about the amount of control banks have over your money?

C) Does the idea of a decentralized network of anonymous individuals working together to build an online currency intrigue you or scare you?

Step 3 – The Practicalities

If your client is comfortable with Bitcoin’s volatility, admires the ideals and is prepared for the fact that they could loose all their money overnight the next step is work out the practicalities.

Buying Bitcoins has become increasingly easy over the last few months. It wasn’t long ago that you could only store the currency on your hard drive. If your hard drive crashed, you lost all your money. Backups were essential.

You can now purchase Bitcoins without too much difficulty on online exchanges/pseudo-banks. The two most popular are MT. Gox and Coinbase. There are no fees for holding Bitcoin, only a transaction fee for purchase (typically 1%). I am not aware of any method of managing Bitcoins through a wrap platform so a client would likely need to sign up for themselves. This is not practical but expected given Bitcoin it is a recent invention.

Finally, the tax implications for Bitcoin are yet to be established. The working assumption is that Bitcoin is a store of value similar to gold or other commodities and will be taxed as capital gains.

Concluding Thoughts

Investing in Bitcoin is a high-risk strategy. I would only invest if your clients are prepared to loose all of their investment over night. If they are not prepared for this kind of risk, then I would avoid this opportunity and move on to the next.