Why You Should Ignore Your Client’s Age when Risk Profiling [UK SURVEY INSIGHTS]

How much should age be a factor in assessing your client’s risk profile? I think close to nil. It’s a common assumption within financial planning that younger people have a higher propensity for risk. The problem with this assumption is that every client has a unique set of circumstances.

You cannot determine their Risk probability profile from their age anymore than you can from their gender. I still come across mistaken profiling tools and questionnaires that seek to determine someone’s by their age. Yet on the surface the evidence would seem to support their claim that you can use age to determine your client’s profile.

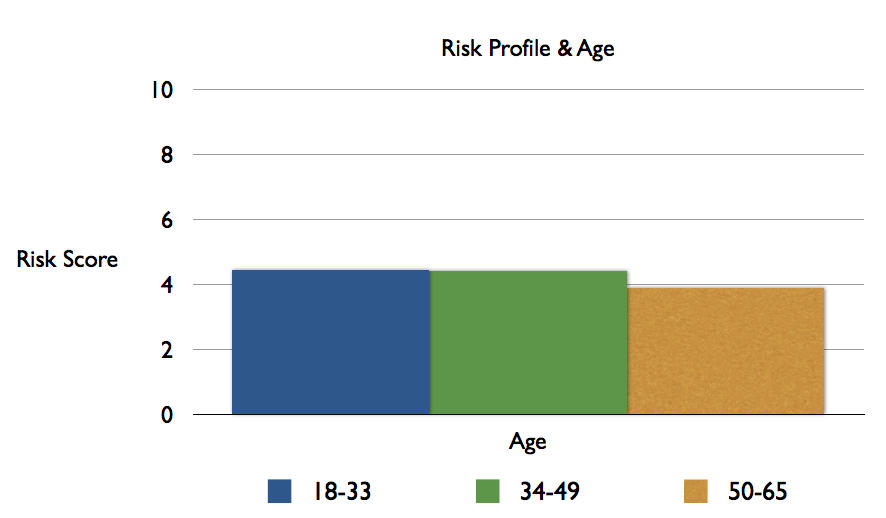

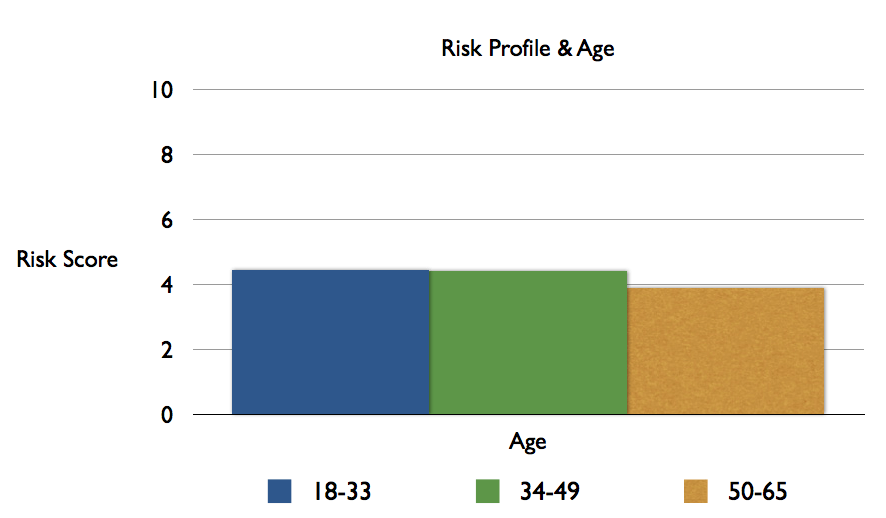

We commissioned AYTM to run a survey of 400 people in the UK from a cross-section of society to find out how they feel about risk. 55% of the respondents were female and 45% were male. Ages ranged from 18-65 and income from £0 to over £320,000. We asked these people a series of questions based on the Pocket Risk questionnaire to assess their level of risk. We then scored their answers from 0-10. This is what we found.

On average the older you are the more risk averse you become. It’s this kind of evidence that allows people to jump to the conclusion that older people should have conservative portfolios. This is an over simplification. What is being forgotten is how much risk someone needs to take. Let’s look at two examples below…

Client A: 57 years old well funded pension, poor health and high job security.

Client B: 62 years old poorly funded pension, good health and low job security.

If we were to put these clients through a risk profiling process that emphasizes age then client A would have a more aggressive portfolio that client B simply because she is younger. However, its clear she does not need to take as much risk given her well funded pension, lower life expectancy and high job security.

The example above is exaggerated but it demonstrates the point that age cannot tell us how much risk someone should take. Needs are far more important. Whether it’s buying a house, paying for schools fees or starting a business.

When developing the Pocket Risk questionnaire we initially thought that age could tell us something useful about a client’s profile but we quickly changed our minds when we considered scenarios such as the above. Age is at best a proxy for need but that’s where its use should stop.