It’s difficult to pick up an industry publication, attend a conference or speak to a fellow advisor without discussing the threat of robo-advisors. There is no doubt they will change our industry forever but what is the solution for the financial advisor?

Over the last week I’ve been reading Blue Ocean Strategy: How To Create Uncontested Market Space And Make The Competition Irrelevant. The book offers a framework to deal with competition. A series of steps that go beyond differentiation or cost cutting, the typical response to competitive threats. The main arc of the book is that to defeat your competition you must make them irrelevant typically by appealing to a new customer segment.

Through a process called value innovation it is possible to create a business that is cheaper (either for you to produce or the consumer to buy) and better. The classic example is Cirque Du Soleil who created a brand new market with their artistic and theatrical circus performances a world away from tents, lions, ringmasters and deadpan humor.

So how can we apply value innovation to financial advice? The first step is to understand the criteria under which people buy financial advice and who are the competitors. Here is my list….

Criteria for Buying Financial Advice

Price / Fees – How much does it cost?

Performance – Will I make money?

Ease – Is the process easy to buy and manage?

Trust / Relationship – Can I trust the service/person and build a relationship?

Time – How long does it take to start and finish?

Goals – Will I have a set of goals and a plan I can believe in?

Education – Will I be more financially astute?

Personalization – How personalized is the service?

Competitors Offering Financial Advice

Financial Advisors – In all their shapes and sizes

Robo-Advisors – Wealthfront, Betterment, etc

Family and Friends

Do It Yourself

Plotting The Competitors

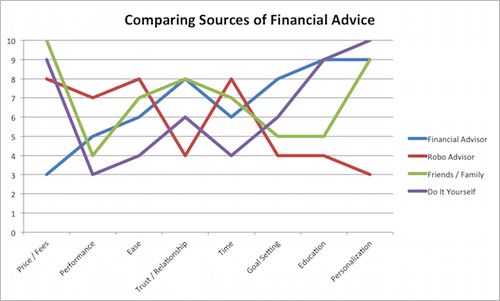

Using my judgment I’ve plotted the relative performance of different competitors in each area. For example, robo-advisors are cheap compared to the average financial advisor but they do not offer much in terms of personalization.

The point of the exercise is not to be 10 in everything. That is nearly impossible. The point is to find uncontested market space. So what opportunities exist for financial advisors given the current situation? The evidence would seem to suggest that advisors should not manage money directly.

As you can see from the chart above, the average financial advisor is great at goal setting, education, personalization but score poorly in fees and investment performance. Obviously there are advisors that perform well for their clients but the general perception is that fees erode performance. A solution to combat the threat of robo-advisors is not to manage money at all. Either outsource it to a robo-advisor, an inexpensive 3rd party money manager or become a coach and encourage clients to do their own buying and selling.

There is no advantage in offering a broadly diversified passive portfolio. As Michael Kitces says “Building a well-diversified passive strategic portfolio is on its way to being totally commoditized“. A less revolutionary approach to ridding yourself of money management has been advocated by people such as Deborah Fox of Fox Financial Planning Network, who suggests that a two tier service level could be the best approach for advisors. For some, even this is drastic.

The Blue Ocean Strategy offers other suggestions for advisors. For example, selling your skills to a new industry e.g. Employer retirement plans, institutions or getting into business planning. There is also the option to cut across client groups e.g. (Having a price point between robos and existing advisors and simply providing online advice).

What would I do if I were a new financial advisor?

I like to think what would I do if I were a brand new financial advisor (admittedly an easier situation than converting an existing business). I suspect I would probably partner with a robo-advisor to do the investment management, provide online financial advice (so I could be nationwide) and focus on a particular sort of client base (e.g. entrepreneurs, doctors, lawyers, people 50-55).

There is a gap in the market between robos and traditional advice. Vanguard and Personal Capital have attempted to enter it with their hybrid model and I believe they will be successful. Therefore an advisor will need a specialism (e.g. doctors, military personnel etc) where Vanguard can’t compete because of their scale. You can charge more than Vanguard (whose fees start at $300 a year) and anchor your pricing next to something that has nothing to do with financial advice but people pay a lot more for e.g cable tv.

You are probably thinking this doesn’t sound like a very scalable business. I disagree by attracting clients who have never bought financial advice I believe it would be possible to create a profitable sustainable business (though it may very well be smaller than what you have today). Walmart is not the only food retailer (just look at Whole Foods) and therefore Wealthfront or Vanguard don’t have to be the only people selling financial advice.

In the long run (10+ years) I can’t help but see financial advice being broken into three categories. Swiss style white glove service for multi millionaires, primarily online hybrid services, and do it yourself robo-advisors. I believe the best bet for advisors is to offer a hybrid service. It’s the only relatively uncontested market place that exists.