Harold Evensky’s 5-step client on-boarding process

Successfully on-boarding new clients is a common concern of financial advisors. As you know, those first few experiences a client has with your practice will color the relationship you have for years to come. Failure to understand your client, set expectations and begin on a positive note will lead to dissatisfaction and churn.

When advisors talk to me about their existing risk profile questionnaire they are often looking to revamp their entire on-boarding process. I wanted to speak and learn from the best in this area so I turned to the “dean of financial planning”, Harold Evensky. Evensky outlines his approach in “The New Wealth Management: The Financial Advisor’s Guide to Managing and Investing Client Assets.” The 480-page book goes into detail about how advisors can ensure the success of their clients and their business through a thorough investment management process. Today, I am going to focus on the client onboarding process, which is essential to setting the right tone for your relationship.

Evensky’s process can be broken into five main steps. Client relationship, client goals and constraints, risk, data gathering and client education.

1. Client Relationship

Evensky begins where you would expect. He states “because everything is client driven, developing a strong relationship with the client is critical”. A solid relationship must be “built on communication, education and trust”. So why is the relationship so important?

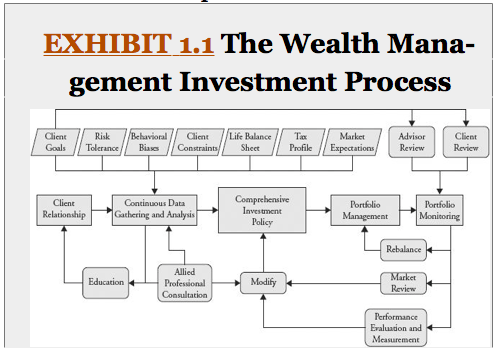

If we look at the Evensky’s wealth management process diagram below, you can see that the client relationship is essential to gathering the data you need to service your client. Without a good relationship it will be challenging to identify the “unique characteristics” of each individual. Evensky goes on to state that a “deft” wealth manager learns his or her clients traits and biases and develops tactics to address them so as not to sabotage the client’s end goals.

2. Client Goals and Constraints

“Goals must be time and dollar specific and prioritized”. Evensky refuses to accept simple goals such as “having enough to retire” or “paying for my children’s education”. Since goals are the “foundation on which all subsequent work depends” a considerable amount of time and effort must be spent to get them right.

However, it’s not enough for advisors to simply ask a client for their goals. An advisor must look for “hidden goals” especially relating to risk management, cash reserves and anticipated large case expenses that a client may have.

Evensky then takes pains to always consider the impact of inflation on any goals, the limitation of mortality tables when retirement planning and the importance of educating the client on goal prioritization.

Beyond goals the constraints of the client also have to be considered. This typically means time horizon and liquidity needs. To avoid selling a volatile asset when the value is low Evensky and Katz have developed a cash flow reserve account system to meet the short-term cash needs of their clients (typically two years of cash flow needs). Any investment funds (excluding the cash) should be committed for at least five years.

In fact the mantra of the firm is “Five years, five years, five years!” By ensuring a client has sufficient cash on hand they avoid a client’s impulse to sell at the bottom. There is an opportunity cost to having that much money in cash but Evensky thinks it is fair price to pay given the overall benefit to the portfolio.

3. Risk

Evensky states that risk is a responsibility of the advisor. Not just to manage it but to educate clients about it. The first step for an advisor is to get the definitions correct. They must balance a client’s risk tolerance (willingness to risk) with their risk capacity (ability to take a risk). Someone with a high-risk tolerance but little capacity should not be in an overly aggressive portfolio. Conversely someone with a low risk tolerance but a high capacity could invest more aggressively if it is necessary to meet their goals.

However, understanding risk does not stop there. Evensky thinks it is prudent for advisors to become familiar with the common behavioral finance missteps all investors are liable to make. These include availability bias, overconfidence, panic, confirmation bias, mental math, framing and others. By going through this checklist Evensky believes advisors are less likely to make mistakes on behalf of their clients.

4. Data Gathering and Analysis

Data gathering is about capturing your client’s circumstance and looking for any inconsistencies or unrealistic expectations. Evensky captures his client’s risk tolerance, risk capacity, capital needs (typically short term) as well as the standard fact finding information (e.g. name, age, current assets etc.). This is then discussed with the client. The goal is to ensure the advisor has the right information to conduct their analysis.

5. Client Education

“A better educated client is a better client.” Before Evensky asks clients to fill out a risk questionnaire he gives them a 30-90 minute mini educational program. The goal of the program is simple. To explain certain investment fundamentals so they can make informed decisions.

The program covers modern investment theory (asset allocation, types of risk), vocabulary (covering terms like volatility, style, risk), information on the firm’s biases (e.g. being against market timing) and an overview of the financial planning process. When a client has this information an advisor can better manage their expectations and ensure their satisfaction.

Conclusion

So as you can see Evensky has developed a thorough on boarding process for his new clients. It’s all about educating the client and getting the information you need to give the best advice.

What other steps would you include in your client on-boarding?

Image Credit – http://www.investmentnews.com/