Morningstar Risk Tolerance Questionnaire – The Good and the Bad

There are many risk questionnaires used by financial advisors and the most common appear to be bundled in with software an advisor is already using. Morningstar is a popular tool used by financial advisors for investment research and financial planning. I often get asked my opinion on the Morningstar risk questionnaire. So today, I am taking a deeper look at the good and the bad.

Click here to get the Morningstar Risk Questionnaire PDF

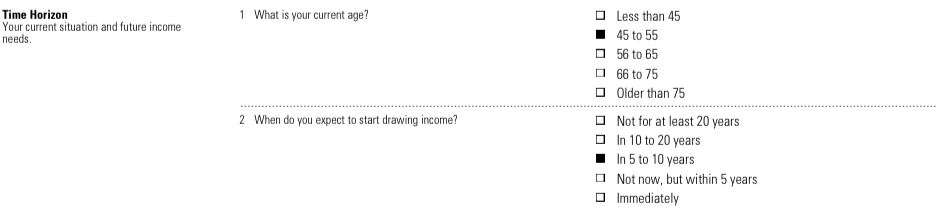

Morningstar Risk Questionnaire – Time Horizon

The Good

- The good thing about the time horizon section is that the questionnaire is attempting to establish some sort of goal for the client by asking about their age and when they expect to start drawing income. That being said this is supposed to be a risk tolerance questionnaire not a collection of goals. How much risk someone is willing to take is not the only factor in determining someone’s goals. You also have to look at their needs and risk capacity.

The Bad

- Age in itself is not a clear indicator of risk tolerance. It’s possible that someone who is older than 75 has a higher risk tolerance than someone who is less than 45. There is dangerous assumption in the question that to be older is to be more conservative. This is not necessarily true and can result in younger people having overly aggressive portfolios and older people having portfolios that are too conservative.

- The second question assumes the client wants to draw income. Again this is an assumption that may not be true for all clients. That being said most clients of financial advisors are looking to draw income at some stage so I think this question is fair.

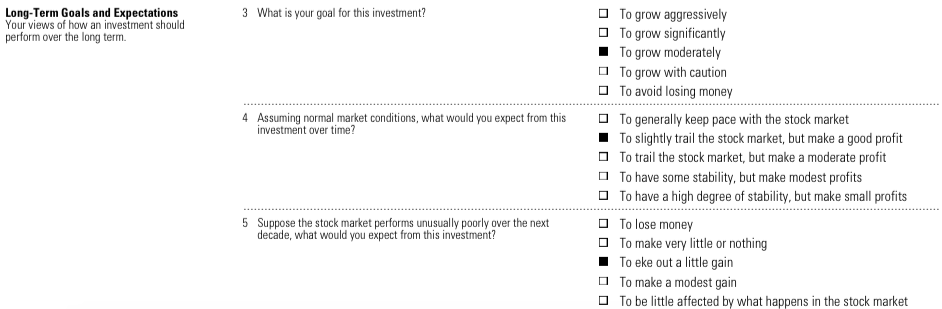

Morningstar Risk Questionnaire – Long Term Goals and Expectations

The Good

- Again there is an emphasis on the client’s goals, which is good to know but I am left wondering if this is the right place to ask such a question. Are we trying to establish someone’s risk tolerance or their goals? These two factors often conflict.

- Question five is interesting and speaks well to understanding a client’s expectations.

The Bad

- Question three is ok but I wonder if the question covers all the goals a client could have. For example, a client could have different goals for different buckets of money. Or maybe they just want to meet their retirement needs but they have no idea if this requires aggressive growth or “to grow with caution”.

- Question four is challenging because of the use of “normal market conditions”. What is normal? Is this the last year? 10 years? 50 years. Other than that, I like the answer options.

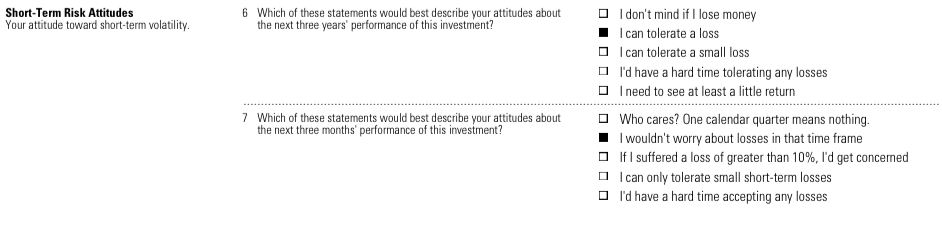

Morningstar Risk Questionnaire – Short Term Risk Attitudes

The Good

- I like question 7. Again, seeing how a client feels in the short run helps an advisor manage expectations. The specificity of the third answer option (10%) makes it clear what type of loss we are talking about.

The Bad

- Question six starts off good. I like the question. However, the answer options are too vague. Someone may be comfortable with a “small loss” but what is a “small loss”? 1% 10%, 15% or more? It is unclear from the options resulting in the advisor having to make an assumption.

Conclusion

The Good

- The questionnaire makes a decent effort at understanding client expectations and there is a fair attempt at understanding their goals.

The Bad

- Frankly, this doesn’t appear to be a Investment Risk Profiler it’s more of a hodgepodge of questions designed to understand the very basics about a client and it struggles to do that conclusively.

- Too few questions. It’s unlikely that someone’s investing future can be determined by 7 questions. There’s just not enough detail to make the final result reliable.

- Where have these questions come from? Was there any science or academic research behind its development? Without this its accuracy can and will be questioned.

For those advisors who wish to go deeper with their clients and have a thorough understanding of their risk tolerance I would be a little cautious about the Morningstar risk questionnaire. It’s basic and you would most likely need to ask many face-to-face questions on top to learn more about your client.