What happens to the returns of your clients’ portfolios when more and more companies go public later and later? Will returns be privatized and kept in the hands of the few?

Staying Private

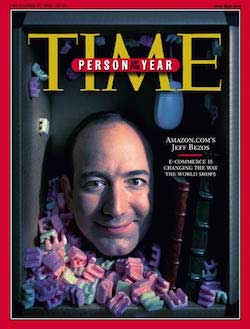

As the Wall Street Journal noted Amazon went public at a market cap of $440m and it now stands at $174bn. Uber, the on demand taxi service is still private at a $40bn valuation. It only has to multiply 19 times before it is the most valuable company in the world while Amazon has gone up 395 times since it’s market debut and is not even in the top ten.

Increasingly the best companies can stay private for a longer period, getting their funding from venture capitalists, hedge funds and private equity. As a result the general stock market investor misses out on the growth of these companies.

A few months back I was reading the biography of Sam Walton and came across his IPO experience. Essentially Wal-Mart had been built on bank loans and was maxed out. Going public was their only option to get out of debt and fund their growth. Thankfully, the public benefited from having this company in public hands. But I wonder how many “Wal-Marts” we are missing out on, because of increased periods of private ownership.

Is it impossible to believe that the Wilshire 5000 index will one day no longer be representative of American business? I don’t think so and if it is not representative will it produce the returns people need to meet their retirement goals? That’s a scarier question with no answer.

Investing Private

The Canadian Pension Plan Investment Board have publicly stated that about 40% of their portfolio will be in illiquid private investments. They believe that the short termism of public markets hurts long-term returns and runs contrary to their goals. It makes you wonder whether “buying the index” is best path to financial security for those in the early years of accumulation. Sure it worked for the last 50 years but as the saying goes, “past performance is not indicative of future results”.

Admittedly, buying public securities is the best we have and from where I sit today likely the best course of action, however I believe having alternative investments will become more important for the average investor.

Alternative Investments?

What do I mean by “alternative” investments? I mean real estate, startups, peer to peer lending and others. Thanks to platforms like Angel List and Realcrowd people can invest for as little as $1,000 avoiding some of the high minimums that have characterized investing in these industries.

Is alternative investing risky? Well, Warren Buffett says risk comes from “not knowing what you are doing”. So clients will probably need to become more savvy investors, start small and expand where necessary.

Historically, the cost of successful index investing has been patience and limiting bad behavior. This has been a good deal for many investors over the years but I wonder if it is a sufficient cost for the next generation of investors to meet their retirement needs. They may have to become more active.